The $5 Challenge: Save Over $1,000 This Year

Embarking on the $5 Challenge: How to Save Over $1,000 This Year With Small Daily Savings is a straightforward path to boosting your financial well-being.

It’s a practical approach that transforms seemingly insignificant daily decisions into substantial savings, proving that you don’t need a massive income to make a real difference in your bank account.

Understanding the $5 Challenge: A Simple Start to Big Savings

The $5 Challenge is more than a simple savings technique—it represents a powerful mindset shift around money.

At its core, the challenge asks you to consistently set aside just five dollars every single day. While the amount may seem insignificant at first, the true strength of the $5 Challenge reveals itself over time.

When practiced for 365 days, those small daily contributions add up to $1,825, proving that consistency can outperform intensity in personal finance.

What makes this challenge especially appealing is its simplicity. The $5 Challenge doesn’t require drastic lifestyle changes, advanced budgeting skills, or complex financial tools.

Instead, it relies on repetition, discipline, and the psychological boost that comes from daily success. Each small win reinforces positive behavior, making saving feel achievable rather than restrictive.

Many people struggle to save money because large financial goals feel overwhelming. Saving hundreds of dollars a month can seem unrealistic, especially when budgets are already tight.

The $5 Challenge breaks this mental barrier by transforming a daunting goal into a manageable daily habit.

Rather than focusing on what you can’t afford to save, the challenge encourages you to identify small, everyday opportunities to set money aside.

Another strength of the $5 Challenge is its flexibility and accessibility. It works well for people at nearly every income level because adjusting five dollars a day is often far more realistic than cutting large monthly expenses.

Whether that $5 comes from skipping a coffee, packing lunch, or avoiding impulse purchases, the challenge teaches awareness and intentional decision-making around spending.

Ultimately, the $5 Challenge helps build confidence with money. As savings grow steadily, participants begin to trust their ability to manage finances, set goals, and stay consistent.

What starts as a simple daily habit often becomes the foundation for larger savings strategies, emergency funds, and long-term financial stability.

The philosophy behind consistent saving

Building a habit: Daily savings reinforce financial discipline.

Overcoming inertia: Small amounts are less intimidating, encouraging action.

Visible progress: Watching savings grow motivates continued participation.

The beauty of this challenge lies in its simplicity. You don’t need special apps or elaborate spreadsheets to track your progress, although these tools can certainly enhance the experience.

A simple jar on your counter or a dedicated savings account can suffice. The key is to make the act of saving five dollars a day as automatic as possible, integrating it seamlessly into your routine until it becomes second nature.

This consistency is what ultimately leads to significant financial gains without feeling deprived.

Identifying Your $5 Daily Savings Opportunities

Finding five dollars to save each day might seem challenging initially, but once you start looking, opportunities often present themselves.

The goal is not to sacrifice essential needs but to identify small, often unnoticed expenditures that can be redirected.

These are typically discretionary purchases that, while enjoyable, don’t contribute to your long-term financial health.

Think about your daily routines. Do you grab a coffee on your way to work? Do you impulse buy snacks or drinks?

These small purchases add up quickly. By making conscious choices to forgo some of these non-essential items, you can easily free up five dollars or more.

It’s about being mindful of where your money goes and making deliberate decisions to reroute those funds towards your savings goal.

Common areas for daily cuts

Coffee and beverages: Brewing at home saves significantly.

Snacks and impulse buys: Packing your own can avoid daily purchases.

Unused subscriptions: Canceling even one small service can free up funds.

Beyond cutting back, you can also look for ways to earn an extra five dollars. This could involve selling an unused item, taking on a small gig, or even finding loose change around the house.

The flexibility of the $5 Challenge means you can adapt it to your lifestyle, whether by reducing spending, increasing income, or a combination of both.

The important part is making that five-dollar contribution a priority each day.

Strategies for Automating Your Daily $5 Savings

Consistency is paramount in the $5 Challenge, and automation is your best friend in achieving it. Relying solely on willpower to manually transfer five dollars every day can lead to missed days and eventual abandonment of the challenge.

Setting up automatic transfers ensures that your savings grow steadily without you having to think about it constantly.

Many banks offer features that allow you to set up recurring transfers from your checking account to a savings account. You can schedule a daily transfer of five dollars, or if that’s not feasible, a weekly transfer of $35.

The goal is to remove the human element of remembering to save, making the process seamless and effortless. This approach transforms saving from a chore into an invisible background process that steadily builds your wealth.

Leveraging technology for effortless saving

Automated bank transfers: Set up daily or weekly recurring deposits.

Round-up apps: Apps that round up purchases to the nearest dollar and save the difference.

Dedicated savings accounts: Create a separate account specifically for your challenge funds.

Another effective strategy is to use digital tools that link to your spending. Some apps can analyze your transactions and automatically transfer small amounts to savings based on your spending habits.

This can be particularly useful for those who find traditional budgeting difficult. By making the saving process automatic, you significantly increase your chances of successfully completing the $5 Challenge and reaching your financial goals.

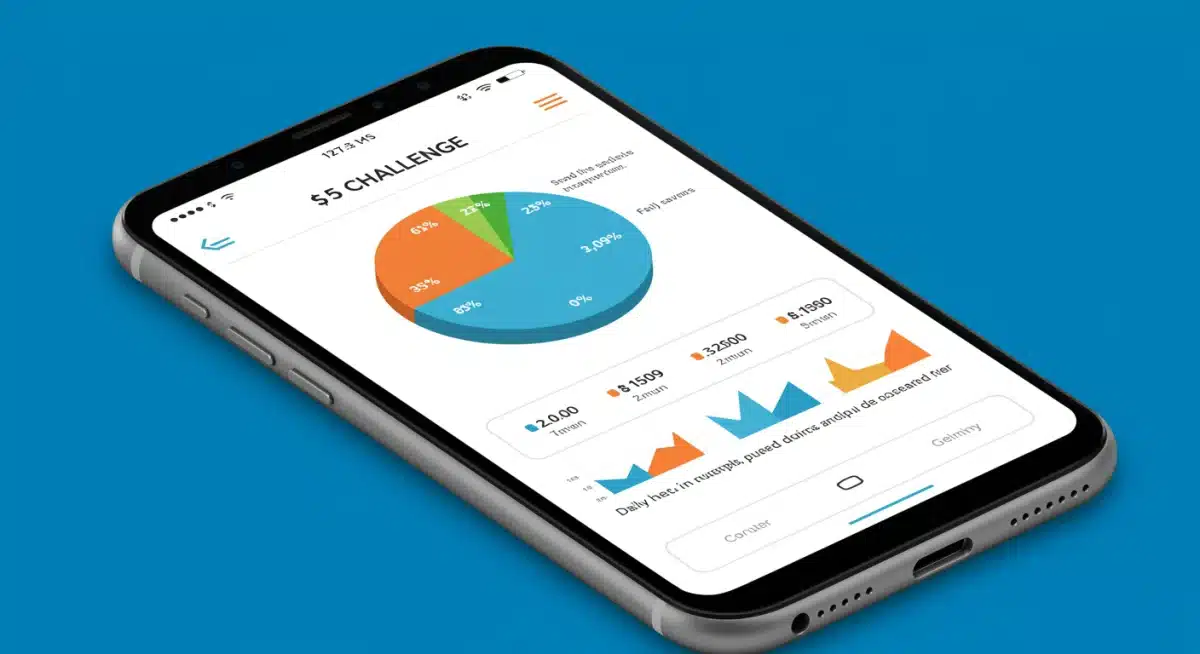

Tracking Your Progress and Staying Motivated with the $5 Challenge

Seeing your savings grow is incredibly motivating. Tracking your progress is a vital component of the $5 Challenge, as it provides visual proof of your efforts and keeps you engaged.

Whether you use a simple spreadsheet, a dedicated app, or even a physical jar where you can see the money accumulate, knowing where you stand can be a powerful incentive to continue.

Regularly reviewing your savings can also help you identify patterns and make adjustments if needed.

If you find yourself consistently missing days, tracking can highlight this, prompting you to re-evaluate your methods or find new ways to free up that five dollars.

Celebrating small milestones, like reaching your first $100 or $500, can also provide a much-needed boost to your motivation and reinforce the positive habit of saving.

Effective tools for monitoring your savings

Spreadsheets: Simple, customizable, and easy to update.

Budgeting apps: Offer visual tracking, categorize spending, and set goals.

Physical savings jar: Provides a tangible representation of your growing funds.

Sharing your progress with a trusted friend or family member can also add an element of accountability.

Knowing that someone else is aware of your challenge can make you more likely to stick with it.

Ultimately, the goal is to transform saving from a chore into an enjoyable and rewarding part of your financial journey, and effective tracking is key to achieving that transformation.

Beyond the $5 Challenge: Scaling Up Your Savings Efforts

While the $5 challenge is an excellent way to build momentum, it doesn’t need to be your only savings strategy.

Once saving five dollars a day becomes a natural habit, this challenge often sparks the confidence and discipline needed to pursue even larger financial goals.

Think of it as a foundation—one that prepares you to expand your savings efforts with ease.

As the $5 challenge becomes second nature, consider gradually increasing your daily contribution. You might move up to saving $10 a day or combine this approach with another savings challenge, such as the 52-week money challenge, where contributions increase each week.

These layered challenges help you grow savings faster without feeling overwhelmed.

The skills developed through the $5 challenge—consistency, mindful spending, and automation—are transferable to any financial goal.

By applying these principles, you can scale your savings strategy, strengthen long-term financial habits, and continue challenging yourself to reach new levels of financial stability and success.

Next Steps for Advanced Savers

Once you’ve established a consistent saving habit, the next phase is about thinking strategically. Advanced savers don’t just focus on saving more—they focus on using money with intention, aligning daily decisions with long-term goals, and making their savings work harder over time.

These next steps help transform steady saving into sustainable financial growth.

Increase daily contributions gradually

As saving five dollars a day becomes second nature, gradually increasing your daily contribution can significantly accelerate your progress without adding stress.

You might raise your target to $7 or $10 per day, or choose to save more on days when your income is higher or expenses are lower. These incremental increases feel manageable while dramatically boosting annual savings.

The key is pacing. Gradual growth prevents burnout and keeps saving feeling like a positive habit rather than a financial burden.

Invest your savings for long-term growth

Once you’ve built a solid financial cushion, keeping all your money in a standard savings account may limit its potential.

Advanced savers begin exploring low-risk investment options that offer higher returns while maintaining stability.

Options such as high-yield savings accounts, certificates of deposit (CDs), diversified index funds, or retirement accounts like IRAs allow your money to grow through compound interest.

Over time, even modest returns can significantly amplify your savings and help protect your money from inflation.

Set specific, purpose-driven financial goals

Clear goals give your savings direction and meaning. Instead of saving “just in case,” advanced savers assign every dollar a purpose—whether it’s a down payment on a home, retirement security, education funding, travel, or financial independence.

Purpose-driven goals increase motivation, improve spending decisions, and make it easier to stay disciplined during periods of temptation or uncertainty.

Expand your savings mindset beyond daily habits

Beyond daily contributions, apply the same critical thinking that helped you build your initial savings habit to larger areas of your budget.

Reviewing monthly expenses—such as utilities, insurance premiums, phone plans, and streaming subscriptions—often reveals opportunities for significant, recurring savings.

Negotiating bills, switching providers, or eliminating underused services can free up meaningful amounts of money each month.

When these savings are redirected toward investments or long-term goals, their impact compounds over time.

Think in systems, not short-term wins

The most successful savers build systems that support long-term financial health.

Automation, regular financial check-ins, and periodic goal reviews help ensure your strategy evolves as your income, lifestyle, and priorities change.

The key takeaway is simple but powerful: small, intentional adjustments applied consistently across your financial life can compound into substantial wealth over time.

Advanced saving isn’t about restriction—it’s about alignment, clarity, and using money as a tool to support the life you want to build.

Common Pitfalls and How to Overcome Them in Your Savings Journey

Even the simplest savings systems can encounter obstacles. Recognizing common pitfalls early helps you stay consistent and avoid frustration.

Inconsistency

Life gets busy, and savings habits can slip when routines change. Missed contributions don’t mean failure—but repeated inconsistency can stall progress.

Feeling deprived

If your savings method feels restrictive or makes you unhappy, it’s unlikely to last. Cutting something you genuinely enjoy may create resentment rather than financial progress.

Unexpected expenses

Unplanned costs—medical bills, car repairs, emergencies—can disrupt even the best intentions. Without a buffer, it’s tempting to pull money from savings.

The goal isn’t perfection; it’s sustainability. Savings should support your life, not feel like a punishment.

Strategies for Overcoming Common Obstacles

Automate contributions

Automation removes daily decision-making and ensures consistency, even during busy periods.

Choose sustainable cutbacks

Focus on expenses that don’t significantly impact your happiness, such as unused subscriptions or inflated service plans.

Forgive occasional slip-ups

Missing a day or week doesn’t erase progress. Reset quickly and move forward without guilt.

Build a small emergency buffer

Even a modest emergency fund can protect your savings from unexpected expenses and reduce financial stress.

Financial growth is rarely linear. There will be setbacks, adjustments, and learning moments along the way.

The most successful savers are resilient, adaptable, and willing to refine their approach as circumstances change.

By staying flexible and focused on long-term goals, you can continue building momentum and move confidently toward lasting financial stability.

| Key Aspect | Description |

|---|---|

| Daily Goal | Save $5 every day, totaling $1,825 annually. |

| Savings Method | Identify small cuts (coffee, snacks) or earn extra. |

| Automation | Set up automatic transfers to ensure consistency. |

| Motivation | Track progress, celebrate milestones, and stay flexible. |

Frequently Asked Questions About the $5 Challenge

What is the $5 challenge and how much can I save?

The $5 challenge is a simple personal finance method where you commit to saving five dollars every single day.

Over the course of a full year (365 days), this challenge allows you to save $1,825, proving that small, consistent actions can lead to substantial financial results. The true power of the $5 challenge lies in its simplicity—no complex budgeting or drastic lifestyle changes required.

What are the easiest ways to find $5 to save each day for the challenge?

Finding $5 a day for the challenge is often easier than expected. Common strategies include making coffee at home, packing lunches and snacks, avoiding impulse purchases, and canceling unused subscriptions.

Even small spending adjustments can quickly free up the money needed to stay consistent with the $5 challenge without feeling deprived.

Should I use a physical jar or a digital account for the $5 challenge?

Both approaches work well, depending on your personality and habits. A physical jar makes the $5 challenge feel tangible and visually rewarding, which can boost motivation.

A digital savings account—especially one with automated daily transfers—offers security, convenience, and sometimes interest, helping your challenge savings grow more efficiently.

What if I miss a day or can’t save $5 during the challenge?

Missing a day doesn’t mean you’ve failed the challenge. The key is consistency over time, not perfection.

If you skip a day, you can save $10 the next day or add extra contributions later in the week. Flexibility keeps the $5 challenge realistic and sustainable throughout the year.

How can I stay motivated throughout the entire $5 savings journey?

Staying motivated becomes much easier when you track your progress and celebrate meaningful milestones, such as reaching your first $100 or $500 in savings.

Seeing tangible results reinforces positive behavior and builds momentum.

Regularly reminding yourself of your financial goals—whether you’re building an emergency fund, paying down debt, or saving for a vacation—helps maintain focus and purpose.

Sharing your savings journey with friends or family can also provide accountability and encouragement, making it easier to stay consistent over time.

Conclusion

Saving five dollars a day is a powerful reminder that consistency—not perfection—is what truly drives financial success.

By committing to this simple daily habit, you can build a meaningful savings routine capable of generating well over $1,000 in a single year, without drastic lifestyle changes or added financial pressure.

Beyond the numbers, this approach transforms how you think about money. It promotes mindfulness, discipline, and automation, reinforcing positive financial behaviors that extend far beyond short-term goals.

Over time, these habits form a strong foundation that supports budgeting, emergency funds, and long-term wealth building.

Most importantly, this method shows that financial progress is accessible to everyone, regardless of income level.

Small, intentional actions taken consistently can produce remarkable results. By turning everyday choices into steady savings, you create lasting financial momentum—one five-dollar decision at a time.