Maximize Your HSA in 2025: A Step-by-Step Guide

Are you looking to take full advantage of your healthcare dollars?

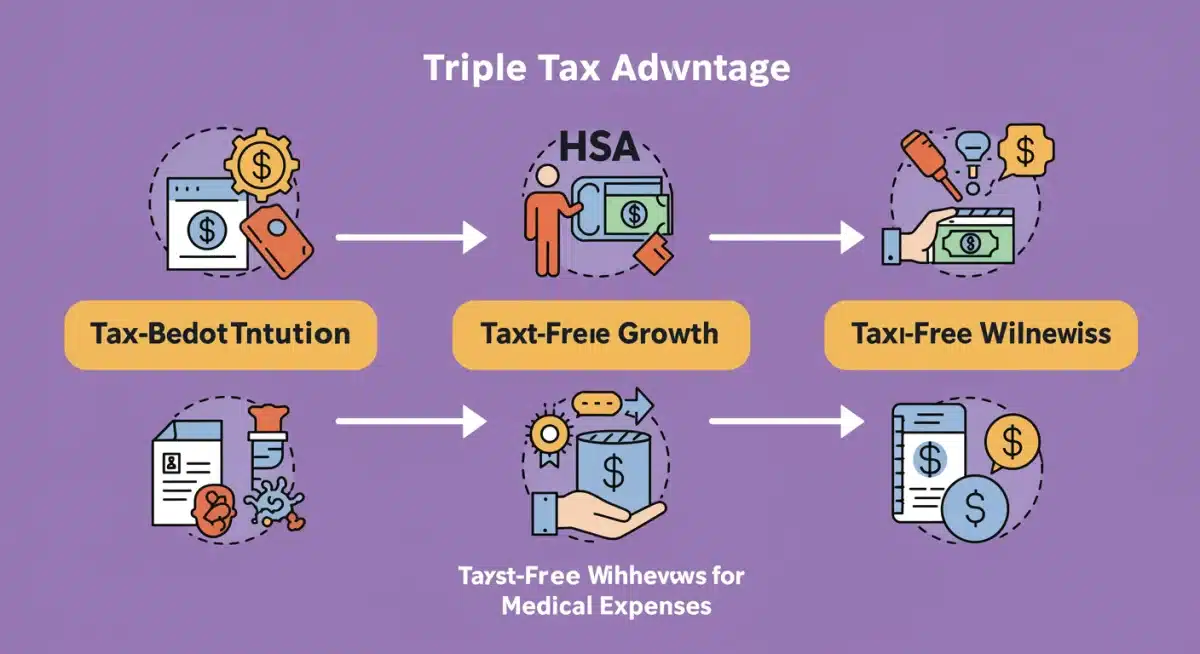

A Health Savings Account (HSA) isn’t just another savings plan; it’s a powerful financial tool that offers a unique triple tax advantage.

This guide will help you understand how to maximize your HSA in 2025, ensuring you’re prepared for both expected and unexpected medical costs while building long-term wealth.

Understanding the HSA Basics for 2025

Before diving into optimization strategies, it’s crucial to grasp the fundamental principles of an HSA. This tax-advantaged savings account is available to individuals enrolled in a High-Deductible Health Plan (HDHP).

For 2025, understanding the eligibility criteria and contribution limits is your first step toward effective utilization. The IRS sets these parameters annually, and staying informed is key.

Eligibility Requirements

To be eligible for an HSA, you must be covered by an HDHP, have no other health coverage (with some exceptions like dental, vision, or specific disease insurance), not be enrolled in Medicare, and not be claimed as a dependent on someone else’s tax return.

These rules are stringent and designed to ensure HSAs are used as intended for healthcare savings.

High-Deductible Health Plan (HDHP): Your health insurance plan must meet specific deductible and out-of-pocket maximum thresholds set by the IRS.

For 2025, these figures are expected to increase slightly from previous years to account for inflation, making it essential to verify your plan’s compliance.

No Other Health Coverage: Generally, you cannot have other health coverage, including a spouse’s non-HDHP plan, that pays for expenses before your HDHP deductible is met.

This ensures the HSA remains the primary vehicle for pre-deductible healthcare costs.

Not Enrolled in Medicare: Once you enroll in Medicare, you can no longer contribute to an HSA. However, you can still use existing HSA funds for qualified medical expenses.

Contribution Limits for 2025

The IRS sets annual limits on how much you can contribute to an HSA. These limits are typically adjusted each year for inflation.

For 2025, it’s projected that the individual contribution limit will be around $4,300, and the family limit around $8,550.

Individuals aged 55 and older can also make an additional catch-up contribution, which is expected to remain at $1,000.

These limits represent the maximum amount you can contribute across all HSAs you might have.

Understanding these basics forms the bedrock of your HSA strategy.

Without meeting eligibility or respecting contribution limits, you risk penalties and undermine the tax advantages.

Always consult your plan administrator or a tax professional for the most up-to-date and personalized information regarding your specific situation.

Maximizing Your Contributions: The Triple Tax Advantage

The core appeal of an HSA lies in its unparalleled triple tax advantage.

This feature makes it a powerful tool for both current healthcare needs and long-term financial planning.

To truly maximize your HSA in 2025, you must understand and fully utilize these benefits.

Tax-Deductible Contributions

Every dollar you contribute to your HSA is tax-deductible.

This means your contributions reduce your taxable income for the year, potentially lowering your overall tax liability.

Whether you contribute through payroll deductions or directly to your HSA provider, these contributions are taken off your gross income, similar to traditional IRA contributions.

This immediate tax break is a significant incentive to fund your HSA generously.

Consider setting up automatic contributions from your paycheck if your employer offers this option. This not only simplifies the process but also allows you to contribute pre-tax dollars, further enhancing the tax savings.

Even if you contribute after-tax, you can claim the deduction when you file your annual tax return.

Tax-Free Growth

Perhaps the most compelling aspect of an HSA is that your funds grow tax-free.

Unlike a regular savings account where interest is taxed annually, any interest, dividends, or capital gains earned within your HSA are not subject to taxes.

This allows your money to compound more rapidly over time, significantly increasing your account balance.

This tax-free growth is particularly beneficial if you plan to invest your HSA funds, which we’ll discuss in more detail later.

The longer your money stays in the HSA, the more substantial this tax-free growth becomes.

This makes HSAs an excellent long-term savings vehicle, especially for retirement healthcare expenses.

The power of compounding means that even small, consistent contributions can grow into a substantial sum over decades.

The third leg of the triple tax advantage is that withdrawals for qualified medical expenses are entirely tax-free.

This includes a wide range of services and products, from doctor visits and prescription medications to dental care, vision care, and even certain over-the-counter medications.

This means you never pay taxes on the money you use for healthcare, neither when you put it in, nor when it grows, nor when you take it out for its intended purpose.

Broad Range of Expenses: Qualified medical expenses are defined by IRS Publication 502 and are quite extensive. Keep meticulous records of your medical expenses, as you’ll need them to justify tax-free withdrawals.

Flexibility: You don’t have to use the funds in the same year you incur the expense.

You can pay for current medical costs out-of-pocket and reimburse yourself from your HSA years or even decades later, allowing your funds to continue growing tax-free.

By maximizing your contributions up to the annual limit, you fully leverage these three tax benefits, making your HSA a cornerstone of your financial and healthcare strategy for 2025 and beyond.

This strategic approach ensures you’re not leaving any tax-saving opportunities on the table.

Strategic Investment of HSA Funds

While many view an HSA primarily as a savings account for immediate medical needs, its true long-term power comes from its investment potential.

To truly maximize your HSA in 2025, you should consider investing a portion of your funds, especially if you have a comfortable emergency fund and don’t anticipate needing your HSA balance for current expenses.

Why Invest Your HSA?

Investing your HSA funds allows you to capitalize on the tax-free growth component.

Over time, invested funds can significantly outperform a simple savings account, turning your HSA into a substantial retirement savings vehicle specifically earmarked for healthcare.

Since healthcare costs are a major concern in retirement, a robust HSA can provide immense peace of mind.

Many HSA providers offer various investment options, similar to a 401(k) or IRA. These can include mutual funds, exchange-traded funds (ETFs), and even individual stocks.

Your choice of investments should align with your risk tolerance and time horizon.

Choosing the Right Investment Strategy

Your investment strategy for your HSA should be tailored to your financial situation and expected healthcare needs.

If you’re young and have many years until retirement, you might opt for a more aggressive portfolio with a higher allocation to equities. If you’re closer to retirement, a more conservative approach might be appropriate.

Assess Your Risk Tolerance: Understand how much risk you’re comfortable taking. This will guide your asset allocation decisions.

Consider Your Time Horizon: The longer your time horizon, the more aggressive you can generally be with your investments. For funds you anticipate needing in the short term, keep them liquid in a cash account.

Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments across different asset classes and sectors to mitigate risk.

Tips for Investing Your HSA

Before you start investing, ensure you have enough cash in your HSA to cover your deductible and any anticipated out-of-pocket expenses for the year.

This ensures you won’t need to sell investments at an inopportune time to cover medical bills. Many experts recommend keeping at least a year’s worth of your deductible in cash within your HSA before investing the rest.

Regularly review your investment performance and rebalance your portfolio as needed. Market conditions change, and your financial goals might evolve.

A proactive approach to managing your HSA investments can help ensure they continue to work effectively towards your long-term healthcare savings objectives.

This strategic investment approach is a cornerstone of how to maximize your HSA in 2025.

Strategic Withdrawal Planning and Record Keeping

While contributing and investing are crucial, knowing how and when to withdraw funds from your HSA is equally important for long-term optimization.

Proper planning and meticulous record-keeping ensure you maintain the tax-free status of your withdrawals and avoid potential penalties.

Understanding Qualified Medical Expenses

For withdrawals to be tax-free, they must be used for qualified medical expenses.

The IRS defines these broadly, covering everything from doctor visits, prescription drugs, and hospital stays to dental care, vision care, and even certain over-the-counter medications if prescribed or for specific conditions.

It’s vital to stay updated on what constitutes a qualified expense, as these rules can occasionally be updated.

Expenses that are not considered qualified medical expenses include general health items (like vitamins not prescribed for a specific condition), cosmetic procedures, or expenses reimbursed by other insurance.

Using HSA funds for non-qualified expenses before age 65 will result in the withdrawal being taxed as ordinary income and potentially subject to a 20% penalty.

The Power of Delayed Reimbursement

One of the most powerful strategies to maximize your HSA in 2025 is to pay for current medical expenses out-of-pocket and save your receipts.

You can then let your HSA funds continue to grow tax-free and reimburse yourself years or even decades later.

This allows your investments to compound for a longer period, resulting in a much larger tax-free nest egg for future healthcare costs, particularly in retirement.

Keep Meticulous Records: This strategy hinges entirely on your ability to keep accurate records of all your qualified medical expenses.

Scan receipts, create a digital folder, or use an app to track everything.

No Time Limit for Reimbursement: The IRS currently imposes no time limit on when you can reimburse yourself for past qualified medical expenses, as long as the expense was incurred after your HSA was established.

Withdrawals in Retirement

After age 65, your HSA essentially functions like a traditional IRA.

You can withdraw funds for any purpose without penalty, though non-qualified withdrawals will be taxed as ordinary income.

Withdrawals for qualified medical expenses remain tax-free. This flexibility makes the HSA an excellent complement to your retirement savings, as healthcare costs are often a significant expense in your later years.

By strategically planning your withdrawals and diligently keeping records, you can ensure that every dollar you’ve saved and invested in your HSA works optimally for you, providing tax-free funds for healthcare when you need them most, throughout your life and into retirement.

Leveraging Your Employer’s HSA Contributions

Many employers recognize the value of HSAs and offer contributions as part of their benefits package. Leveraging these employer contributions is a straightforward yet highly effective way to significantly maximize your HSA in 2025.

These contributions are essentially free money that boosts your healthcare savings and investment potential.

Understanding Employer Contributions

Employer contributions to your HSA are typically made directly to your account. These contributions are tax-free to you and don’t count towards your taxable income.

They do, however, count towards the annual IRS contribution limits. So, if your employer contributes a certain amount, you’ll need to adjust your own contributions accordingly to stay within the limits.

Some employers offer a flat contribution, while others might match a percentage of your contributions or offer incentives for participating in wellness programs.

It’s crucial to understand your company’s specific HSA contribution policy.

How to Maximize Employer Contributions

The simplest way to leverage employer contributions is to ensure you meet any requirements to receive them.

This might include enrolling in a specific HDHP, completing a health assessment, or participating in wellness initiatives. Don’t leave free money on the table!

Review Your Benefits Package: Annually, review your employer’s benefits package to understand the HSA contributions they offer and any conditions attached to them.

This information is often available during open enrollment periods.

Meet Wellness Program Requirements: If your employer offers additional HSA contributions for participating in wellness programs, make sure to complete those requirements.

These programs often include activities like health screenings, tobacco cessation courses, or fitness challenges.

Coordinate Your Contributions: Subtract your employer’s contributions from the IRS annual limit to determine how much more you can contribute.Aim to reach the maximum limit each year, combining both your and your employer’s contributions.

The Impact on Your Overall Savings

Employer contributions act as an immediate boost to your HSA balance, accelerating its growth.

This is particularly beneficial if you are new to HSAs or are trying to build up a substantial balance quickly.

These contributions, combined with your own, can be invested and grow tax-free over time, significantly enhancing your financial security for future medical expenses.

By being proactive and informed about your employer’s HSA offerings, you can significantly enhance your savings strategy.

Employer contributions are a valuable component of an overall plan to maximize your HSA in 2025, providing a strong foundation for your healthcare and financial future.

HSA as a Retirement Planning Tool

Beyond covering immediate medical expenses, the HSA stands out as a unique and powerful retirement planning tool.

Its flexibility and tax advantages make it an excellent complement to traditional retirement accounts like 401(k)s and IRAs, especially when considering the rising cost of healthcare in retirement.

The “Fourth Leg” of Retirement Savings

Many financial experts now refer to the HSA as the “fourth leg” of retirement savings, alongside Social Security, pensions/401(k)s, and personal savings.

This is because healthcare costs are one of the most significant and unpredictable expenses retirees face.

An HSA, properly funded and invested, can provide a dedicated, tax-advantaged source of funds for these costs.

Unlike 401(k)s or IRAs, where withdrawals in retirement for non-medical expenses are taxed, HSA withdrawals for qualified medical expenses are always tax-free, regardless of age.

This makes it an incredibly efficient way to save for a predictable major expense in your golden years.

Integrating HSA with Other Retirement Accounts

For optimal retirement planning, consider how your HSA integrates with your other savings vehicles. If you’re eligible for both an HSA and a 401(k) with an employer match, it’s often recommended to contribute enough to your 401(k) to get the full match, then fully fund your HSA, and then maximize your 401(k) or IRA contributions.

This strategy ensures you’re taking advantage of all available tax benefits.

By viewing your HSA not just as a short-term medical savings account but as a long-term investment and retirement planning tool, you can truly maximize your HSA in 2025, setting yourself up for greater financial security and peace of mind in your later years.

Avoiding Common HSA Pitfalls

While an HSA offers significant advantages, it’s easy to make mistakes that can diminish its benefits or even lead to penalties.

Being aware of these common pitfalls and actively avoiding them is crucial to effectively maximize your HSA in 2025 and beyond.

Over-Contributing to Your HSA

One of the most frequent mistakes is contributing more than the IRS-mandated annual limits. If you exceed these limits, the excess contributions are not tax-deductible and are subject to a 6% excise tax for each year they remain in the account.

This penalty can quickly erode your savings. It’s especially important to monitor contributions if both you and your employer are contributing.

If you realize you’ve over-contributed, you can avoid the penalty by withdrawing the excess contributions and any earnings attributable to them before the tax filing deadline (including extensions) of the year the excess occurred.

The withdrawn earnings will be taxable.

Using Funds for Non-Qualified Expenses (Before Age 65)

As discussed, using HSA funds for non-qualified medical expenses before age 65 results in ordinary income tax on the withdrawal, plus a 20% penalty.

This can be a costly mistake, significantly reducing the value of your savings. Always double-check if an expense qualifies before making a withdrawal.

Keep a List of Qualified Expenses: Familiarize yourself with IRS Publication 502 or keep a quick reference guide handy to ensure your expenses qualify.

When in Doubt, Don’t Withdraw: If you’re unsure whether an expense qualifies, it’s better to pay out-of-pocket and seek clarification or save the HSA funds for clearly qualified expenses.

Failing to Keep Proper Records

This pitfall applies particularly to those employing the delayed reimbursement strategy.

Without meticulous records of your qualified medical expenses, you won’t be able to prove to the IRS that your tax-free withdrawals were legitimate.

This could lead to your withdrawals being reclassified as taxable income and potentially penalized.

Digitize your receipts, create a spreadsheet, or use an expense tracking app. The key is consistency and ensuring you can easily access and present these records if ever audited.

This diligence protects your tax-free status.

Not Investing Your HSA Funds

While not a penalty-inducing pitfall, failing to invest your HSA funds means you’re missing out on a significant opportunity for tax-free growth.

Leaving substantial amounts of money in a low-interest cash account over many years means you’re not fully leveraging the HSA’s potential as a long-term wealth-building tool.

Assess your comfort level with investing and explore the options available through your HSA provider.

By being diligent about contribution limits, understanding qualified expenses, maintaining excellent records, and strategically investing, you can steer clear of common pitfalls and ensure you truly maximize your HSA in 2025 for all its intended benefits.

Advanced HSA Strategies for 2025 — How to Maximize Every Advantage

Once you’ve mastered the basics of your Health Savings Account, the next step is learning how to maximize its full potential in 2025. These advanced techniques can dramatically enhance long-term financial security, boost tax efficiency, and turn your HSA into a powerful wealth-building tool.

The Last-Dollar Strategy — Maximize Tax-Free Growth

This approach focuses on paying all current medical expenses out-of-pocket while allowing your HSA investments to remain untouched for as long as possible.

By doing so, you maximize the tax-free compounding inside your account.

Instead of reimbursing yourself immediately, you save all receipts for future use. Years later — often in retirement — you can make a large, tax-free withdrawal to reimburse decades’ worth of accumulated medical expenses.

This strategy requires discipline and the ability to cover medical costs from non-HSA savings, but the payoff is significant: a much larger maximize-optimized tax-free nest egg for your highest-cost healthcare years.

HSA as a Dual-Purpose Emergency Fund — Maximize Stability + Security

While investing for long-term growth is ideal, your HSA can also act as a healthcare-specific emergency fund. In a medical crisis, readily available HSA funds prevent you from tapping other savings or falling into high-interest debt.

How to maximize this approach:

-

Maintain a Cash Reserve: Keep enough cash in the HSA to cover your deductible and immediate expenses. This liquidity helps you maximize preparedness for unexpected medical needs.

-

Avoid High-Interest Debt: Using your HSA strategically can keep medical costs from turning into credit card balances with steep interest rates.

This dual functionality strengthens both your long-term compounding and your short-term financial protection.

Portability of Your HSA — Maximize Control Across Your Career

One of the most overlooked advantages of an HSA is portability. The account belongs entirely to you — not your employer. If you switch jobs, retire, or move custodians, your HSA moves with you.

You can continue contributing (as long as you remain HDHP-eligible) and using the funds for qualified medical expenses without interruption. This flexibility allows you to consistently maximize your healthcare savings strategy throughout your career.

Transferring your HSA to a custodian with better investment options, lower fees, or improved tools is another powerful way to maximize your account’s performance.

Transform Your HSA Into a Long-Term Wealth Strategy

By implementing these advanced HSA tactics, you go far beyond basic usage. You learn to maximize compounding, tax benefits, retirement flexibility, and financial security, turning your HSA into a lifelong strategic asset.

Frequently Asked Questions About HSAs in 2025 — How to Maximize Your Benefits

What are the HSA contribution limits for 2025?▼

For 2025, individual HSA contribution limits are projected to be around $4,300, and family limits approximately $8,550. Individuals aged 55 and older can contribute an additional $1,000 catch-up contribution. These limits are subject to final IRS adjustments.

Understanding these thresholds helps you maximize yearly tax-advantaged savings.

Can I use my HSA for non-medical expenses?▼

Before age 65, using HSA funds for non-medical expenses results in ordinary income tax plus a 20% penalty.

After age 65, you can withdraw HSA funds for any reason without penalty, although non-medical withdrawals are still taxed as ordinary income — similar to a traditional IRA.

Knowing these rules allows you to maximize strategic withdrawal decisions.

Is an HSA better than a 401(k) for retirement savings?▼

An HSA provides a triple tax advantage, making it exceptionally valuable for future healthcare costs — often outperforming other retirement tools for that specific purpose.

A 401(k), especially with an employer match, remains one of the best ways to maximize long-term retirement savings.

Ideally, you should leverage both for comprehensive financial planning.

What happens to my HSA if I change jobs?▼

Your HSA is fully portable, meaning it belongs to you — not your employer.

If you switch jobs, you maintain complete ownership and control of the account.

You can continue contributing as long as you remain covered by a high-deductible health plan (HDHP). This portability helps you maximize continuity in your tax-advantaged savings strategy.

Do I need to keep receipts for HSA withdrawals?▼

Yes, absolutely. You must retain detailed receipts and documentation for every qualified medical expense you pay with HSA funds.

This is essential for tax compliance and protects you in the event of an audit. Organized records allow you to maximize tax-free reimbursements with confidence.

Conclusion — How to Maximize Your HSA in 2025

As we’ve explored, learning how to maximize your Health Savings Account in 2025 opens the door to greater control over healthcare expenses and a stronger long-term financial foundation.

By leveraging its unique triple tax advantage, making strategic contributions, maximizing investment opportunities, and maintaining meticulous records, your HSA becomes far more than a simple medical savings account.

It transforms into a powerful, flexible financial tool that can support your retirement planning and provide tax-free funds for qualified healthcare needs throughout your life.

When you follow the step-by-step strategies outlined in this guide, you position yourself to maximize every dollar that flows into your HSA — building lasting financial security and long-term peace of mind.